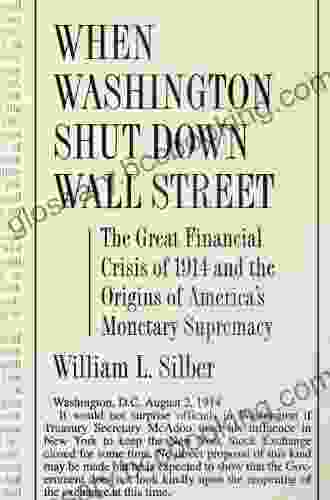

When Washington Shut Down Wall Street: Uncovering the Truth Behind the 2008 Financial Crisis

In the aftermath of the catastrophic 2008 financial crisis, the world was left reeling from its devastating impact. The once-mighty Wall Street was brought to its knees, as the global economy teetered on the brink of collapse. In When Washington Shut Down Wall Street, investigative journalist and financial expert Steve Eisman delves deep into the events leading up to and following the crisis, unveiling the shocking truth behind the biggest economic meltdown in history.

Eisman begins his exposé by tracing the roots of the financial crisis to the subprime mortgage market. In the years leading up to the crash, banks and financial institutions had rampantly issued risky subprime mortgages to borrowers with poor credit histories and low incomes. These loans were packaged into complex financial instruments known as collateralized debt obligations (CDOs) and sold to investors around the world.

As housing prices continued to rise, the value of these CDOs soared. However, when the housing bubble burst in 2007, the value of these mortgages plummeted, triggering a chain reaction that spread throughout the financial system.

4.5 out of 5

| Language | : | English |

| File size | : | 4102 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 210 pages |

Eisman meticulously documents the role Wall Street banks played in the subprime mortgage debacle. Driven by greed and reckless lending practices, they knowingly sold these risky mortgages to unsuspecting investors, profiting handsomely from the sale of these toxic assets. Moreover, they failed to adequately disclose the risks associated with these investments, leaving investors vulnerable to catastrophic losses.

Eisman argues that the government's complacency and lack of oversight contributed significantly to the crisis. Despite warnings from financial experts, regulators failed to rein in the reckless behavior of Wall Street and address the growing risks in the financial system.

The Bush administration's policies, such as the Housing and Economic Recovery Act of 2008, which encouraged risky lending, further exacerbated the situation.

In the face of the impending financial collapse, the government was forced to intervene with a series of unprecedented bailouts. The Troubled Asset Relief Program (TARP) poured billions of dollars into struggling financial institutions, while the Federal Reserve lowered interest rates to historic lows.

While these measures averted a complete economic meltdown, Eisman argues that they also bailed out the very institutions that had created the crisis. The lack of accountability for Wall Street executives and the continued existence of these massive banks left the financial system vulnerable to future crises.

In the aftermath of the financial crisis, Eisman offers valuable insights into the systemic flaws that led to the meltdown. He calls for stronger regulation of the financial industry, increased transparency, and a renewed focus on consumer protection.

He also highlights the importance of economic reform to address the growing inequality and systemic risks that persist in the current financial system.

When Washington Shut Down Wall Street is a meticulously researched and compelling account of the 2008 financial crisis. Steve Eisman uncovers the truth behind the reckless behavior of Wall Street, the complacency of regulators, and the government's failure to act.

By providing a comprehensive analysis of the events that led to the crisis, Eisman's book serves as a cautionary tale and a blueprint for preventing such catastrophic events from recurring in the future. It is a must-read for anyone interested in understanding the complexities of the financial world and the impact it has on our lives.

- Image 1: Wall Street Crash of 1929A black-and-white photograph of Wall Street during the crash of 1929, showing panicked investors and traders.

- Image 2: Subprime Mortgage DocumentA close-up photograph of a subprime mortgage document with blurred text in the background.

- Image 3: Government Bailout AnnouncementA newspaper headline announcing the government bailout of the financial industry in 2008.

- Image 4: Author Steve EismanA portrait photograph of Steve Eisman, author of When Washington Shut Down Wall Street.

4.5 out of 5

| Language | : | English |

| File size | : | 4102 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 210 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Jack W Lewis

Jack W Lewis James Mooney

James Mooney Susan Elizabeth Jones

Susan Elizabeth Jones James Greenblatt

James Greenblatt Jacob Dlamini

Jacob Dlamini Philip Gwynne Jones

Philip Gwynne Jones Kenichi Sonoda

Kenichi Sonoda James Thomas

James Thomas James Egan

James Egan Jake Bible

Jake Bible Kiera Stipovich

Kiera Stipovich S C Coleman

S C Coleman James O Aldrich

James O Aldrich Jacqueline Whitmore

Jacqueline Whitmore Jack Hunnicutt

Jack Hunnicutt Sarah Parks

Sarah Parks Jamille Nagtalon Ramos

Jamille Nagtalon Ramos James Nash

James Nash Jacques Audinet

Jacques Audinet Jonathan Knight

Jonathan Knight

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Guy PowellStrange True Tales From The American Southwest: An Unforgettable Journey Into...

Guy PowellStrange True Tales From The American Southwest: An Unforgettable Journey Into... Reginald CoxFollow ·7.4k

Reginald CoxFollow ·7.4k Gil TurnerFollow ·19.6k

Gil TurnerFollow ·19.6k Jay SimmonsFollow ·2k

Jay SimmonsFollow ·2k Bryson HayesFollow ·8.7k

Bryson HayesFollow ·8.7k Hugh ReedFollow ·15.8k

Hugh ReedFollow ·15.8k Shane BlairFollow ·17.5k

Shane BlairFollow ·17.5k Robert BrowningFollow ·9.7k

Robert BrowningFollow ·9.7k Jan MitchellFollow ·7.7k

Jan MitchellFollow ·7.7k

Douglas Adams

Douglas AdamsGingerbread Friends by Jan Brett

A Magical Tale for the Holidays Jan Brett's...

Joseph Foster

Joseph FosterHappy Birthday Moo Moo Family: A Delightful Tale for Kids...

Celebrate the Bonds of Family with...

Demetrius Carter

Demetrius CarterUncover the Enchanting Tapestry of New Delhi: A Visual...

New Delhi, India's vibrant capital, is a...

W.B. Yeats

W.B. YeatsUnveiling the Power of Lean UX: A Comprehensive Review of...

In the rapidly evolving world...

4.5 out of 5

| Language | : | English |

| File size | : | 4102 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 210 pages |